Condo Insurance in and around Janesville

Looking for excellent condo unitowners insurance in Janesville?

Quality coverage for your condo and belongings inside

- Janesville, WI

- Beloit, WI

- Whitewater, WI

- Madison, WI

- Milton, WI

- Edgerton, WI

- Lake Geneva, WI

- Delavan, WI

- Evansville, WI

- Milwaukee, WI

- Stoughton, WI

- Walworth, WI

- Monroe, WI

- Rock County, WI

- Green County, WI

- Dane County, WI

- Green Bay, WI

- Appleton, WI

- Brown County, WI

- Fort Atkinson, WI

- Wisconsin Dells, WI

- Rockford, IL

- Chicago, IL

- Springfield, IL

Home Is Where Your Condo Is

The life you treasure is rooted in the condo you call home. Your condo is where you wind down, take it easy and slow down. It’s where you build a life with family and friends.

Looking for excellent condo unitowners insurance in Janesville?

Quality coverage for your condo and belongings inside

Condo Coverage Options To Fit Your Needs

We get it. That's why State Farm offers outstanding Condo Unitowners Insurance that can help protect both your unit and the personal property inside. Agent Jaysen Jorgensen is here to help you understand your options - including benefits, savings, bundling - helping you create a customizable plan that's right for you.

Ready to take the next step? Agent Jaysen Jorgensen is also ready to help you explore what customizable condo insurance options work well for you. Call or email today!

Have More Questions About Condo Unitowners Insurance?

Call Jaysen at (608) 756-9208 or visit our FAQ page.

Simple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

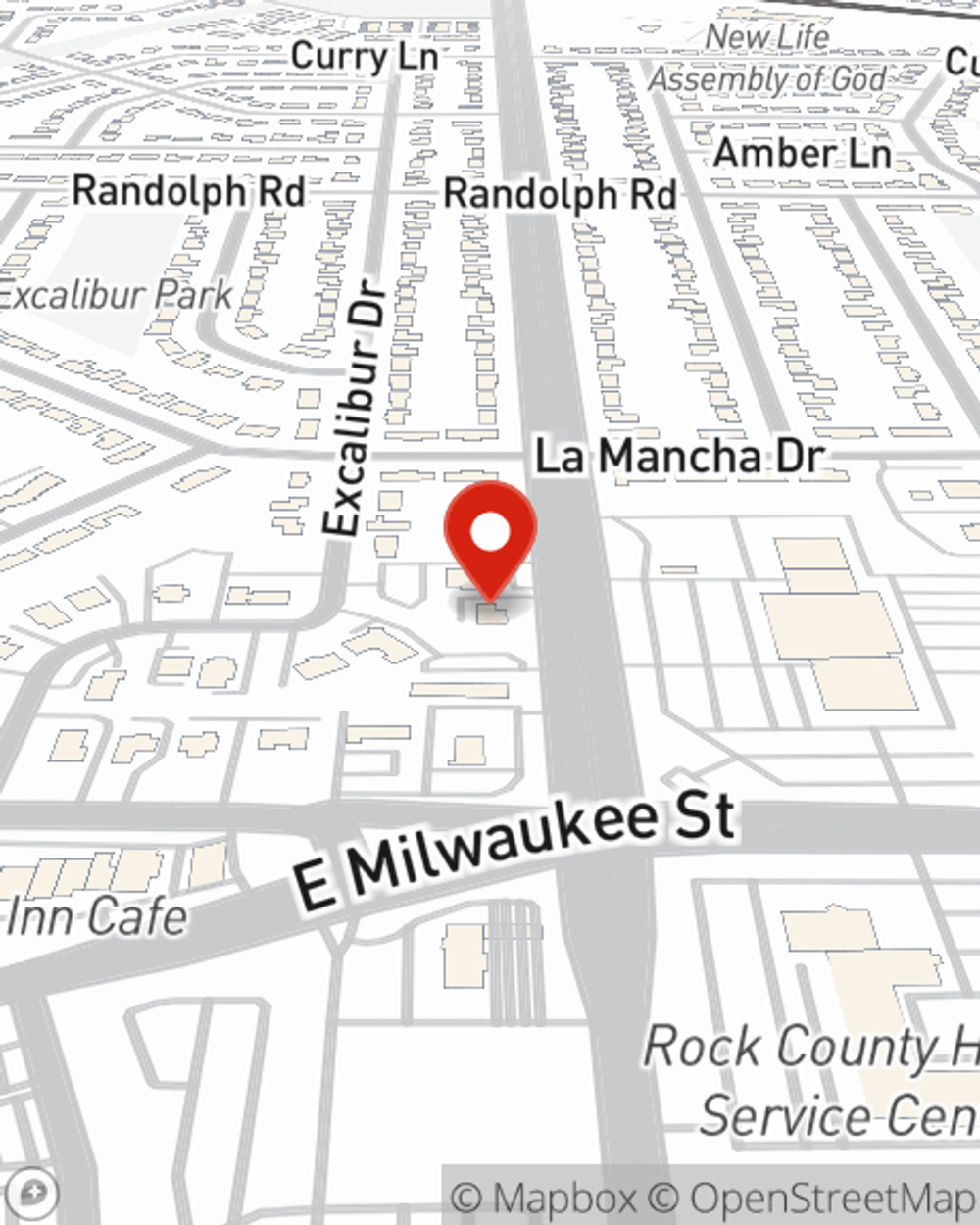

Jaysen Jorgensen

State Farm® Insurance AgentSimple Insights®

Appliance maintenance to-dos for your home

Appliance maintenance to-dos for your home

Regular upkeep of all of your home’s appliances and big systems is a must-do that ensures these investments work well and have long, productive lives.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.